On

the

role

of

normative

evaluations

in

the

potential

output

estimation

procedure

18. November 2025

Prof. Dr. Michael W. Müller

Publications

The Geldbrief is our newsletter on current developments in economic, fiscal, and monetary policy. We appreciate your feedback and suggestions.

Send it to timm.leinker[at]dezernatzukunft.org.

Droht jetzt die Mehrwertsteuererhöhung?

30. October 2025

Wie wird die 30-Milliarden-Euro-Lücke im Haushalt 2027 geschlossen?…

Philippa Sigl-Glöckner

Sondergeldbrief: Tausche Strafzahlungen gegen grünen Stahl – Autodeal verfehlt sein Ziel

9. October 2025

Flottengrenzwerte lockern und Strafzahlungen erlassen, unter der Bedingung grünen Stahl zu nutzen.…

Maximilian Paleschke

Völlig losgelöst: Warum Preise wie Raketen steigen, aber wie Federn fallen

1. October 2025

Seit 2022 stiegen Zementpreise sprunghaft an, kommen aber nicht wieder runter.…

Aurora Li

In our policy- and research papers we tackle questions from fiscal-, monetary- and wider economic policy. We seek to get to the bottom of things and develop feasible proposals that make a difference.

A controversial investment

20. November 2024

The US semiconductor company Intel is planning to build two ultra-modern chip factories near Magdeburg. This project was promised the…

Nils Gerresheim

Beyond Maastricht

19. November 2024

Strengthening Europe’s sovereignty has become a much-debated policy goal. This paper adds three arguments to ongoing discussions.…

Max Krahé

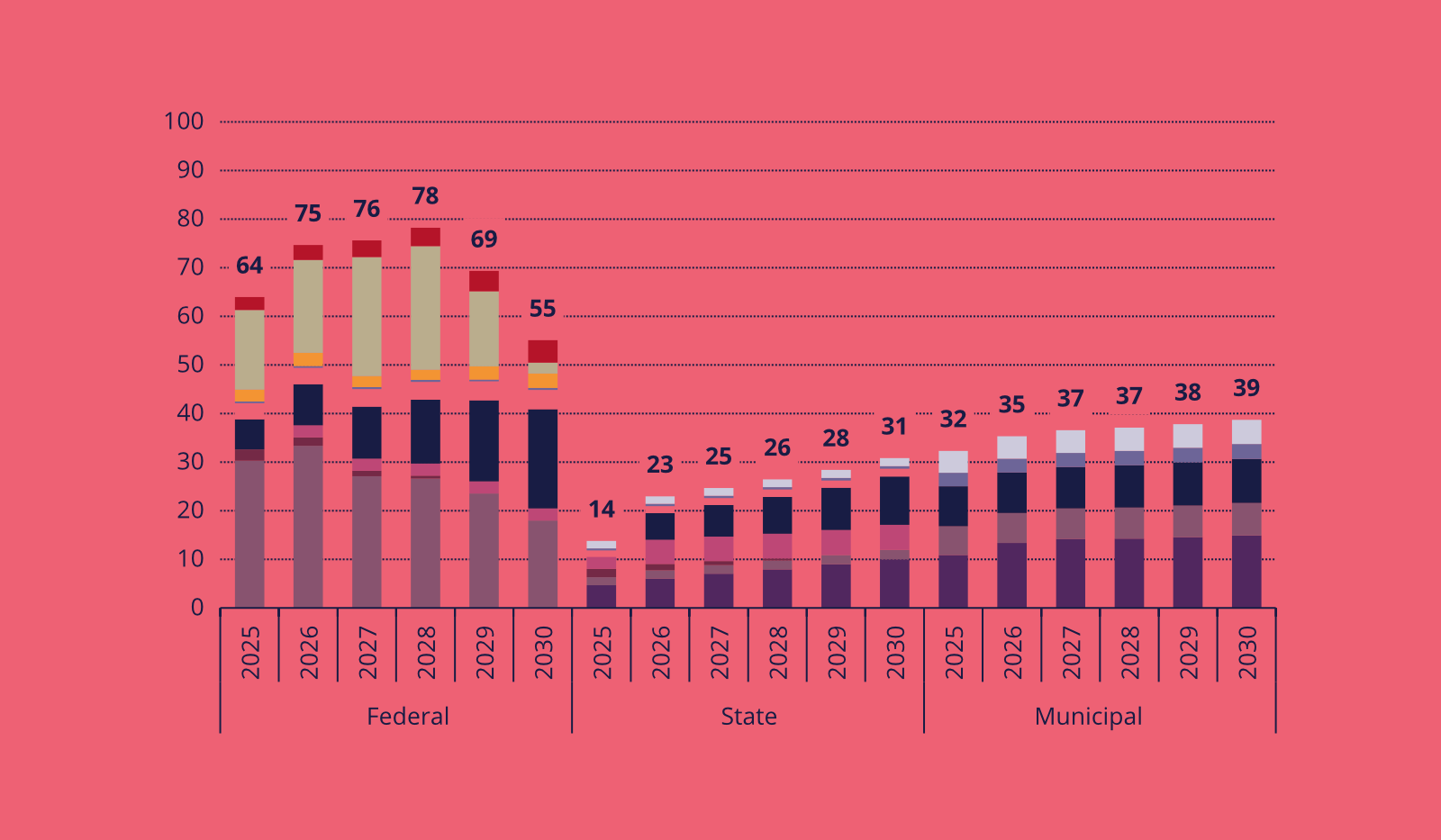

Public financing needs for the modernisation of Germany (Summary)

13. November 2024

This study maps the additional public financing needed to achieve widely accepted targets in areas that are pivotal to Germany’s…

Felix Heilmann

We would like to use our data sets to illustrate economic developments and make discussions more objective. Our data sets can be freely reused provided the source is stated.

First Lessons from the Dezernat Zukunft Supply Side Monitor

15. April 2025

In recent years, inflationary impulses came from supply shocks. The new Dezernat Zukunft Supply Side Monitor provides data on prices,…

Aurora Li

Guide to the Supply Side Monitor

15. April 2025

This is a guide to the Supply Side Monitor (SSM) by Dezernat Zukunft. In a first step the reader will…

Aurora Li

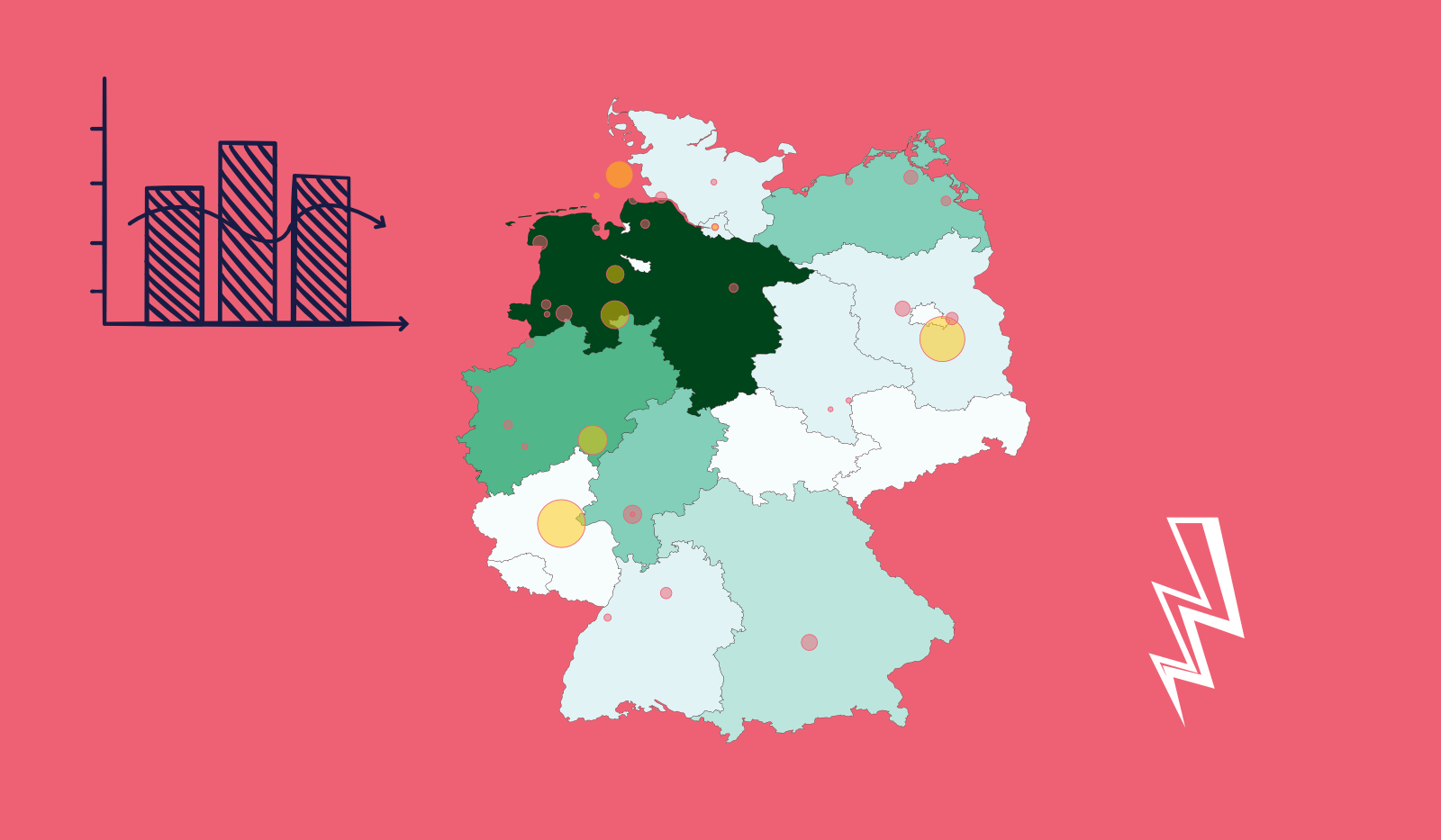

Investitionstracker: Update 2. Halbjahr 2024

23. January 2025

Im Laufe des Jahres 2024 wurden privatwirtschaftliche Großinvestitionen mit einem Gesamtvolumen von 38,7 Milliarden Euro angekündigt oder in die Umsetzung…

Gerrit Schröter

Geldbrief

The Geldbrief is our newsletter on current developments in economic, fiscal, and monetary policy. We appreciate your feedback and suggestions. Send it to timm.leinker[at]dezernatzukunft.org.

All entries

Papers

In our policy- and research papers we tackle questions from fiscal-, monetary- and wider economic policy. We seek to get to the bottom of things and develop feasible proposals that make a difference.

All entries

Datasets

We would like to use our data sets to illustrate economic developments and make discussions more objective. Our data sets can be freely reused provided the source is stated.

All entries

Dezernat Zukunft is a non-partisan policy institute

[custom-twitter-feeds]