EU’s Fiscal Rules Must Catch Up with Climate Reality

Philippa Sigl-Glöckner, Janek Steitz, Vinzenz Ziesemer

Europe’s new fiscal rules rely heavily on forecasts of future debt-to-GDP ratios to set limits on public spending. But there’s a major problem: The models behind these forecasts ignore both climate damages and the full costs of meeting the EU’s climate goals. Today’s rules are effectively blind to climate change.

Debt sustainability analyses (DSAs) used to steer fiscal policy are based on a flawed baseline. If we don’t fix this, countries may end up with overly harsh spending limits—just when investment in climate action is most needed.

Europe’s New Fiscal Compass: Debt Sustainability Analyses

As of late 2024, the EU’s fiscal rules have been revamped. Debt-to-GDP ratios projected 14–17 years into the future serve as the new anchor for fiscal policy. These projections determine how much governments can spend in the short term.

But here’s the catch. Those long-term forecasts miss two important elements:

- Climate damages—like lost productivity or infrastructure destruction from extreme weather.

- The economic impact of climate policy—especially when it relies heavily on carbon pricing.

This means today’s models are effectively blind to climate change.

Climate Change Is Not Just Environmental—It’s Fiscal

Climate change is already hurting Europe’s economy, and it’s going to get worse. Research shows that damages from climate impacts—like heatwaves, floods, and declining agricultural yields—could shave 5–10% off Europe’s annual GDP by 2050. Yet current DSAs barely reflect this.

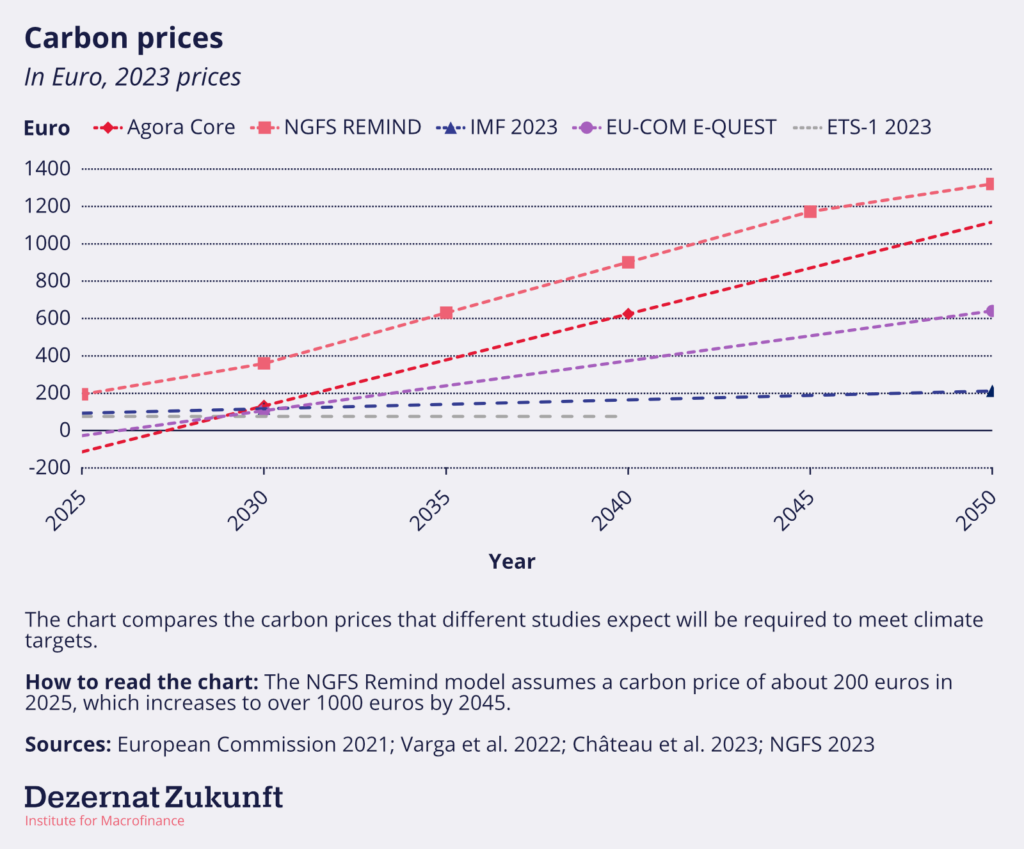

And that’s before factoring in the cost of reaching net zero. The EU is currently counting on carbon pricing to do the job – in particular, the expansion of the Emissions Trading System to buildings, road transport and small industry (ETS2). We’ve reviewed the literature on what this would mean, and learned two things:

- If the EU sticks to carbon pricing as its main tool, GDP could fall by 1–2% just from policy effects. That’s in addition to the impact of damages.

- To get there, we need much higher carbon prices. How much higher? No one really seems to know. Can households carry those costs?

Figure 1

Climate change is missing from DSAs

Regardless of the consequences for households and firms, the European fiscal rules are clear: DSAs must account for policies as they are. But when it comes to climate, that’s not what they seem to be doing. DSAs rely on economic models to forecast growth. But those models:

- Don’t factor in rising climate damages.

- Don’t fully account for the drag on growth from climate policy under fiscal constraints.

This means today’s debt forecasts underestimate how hard it will be to maintain current growth—and overestimate future fiscal space.

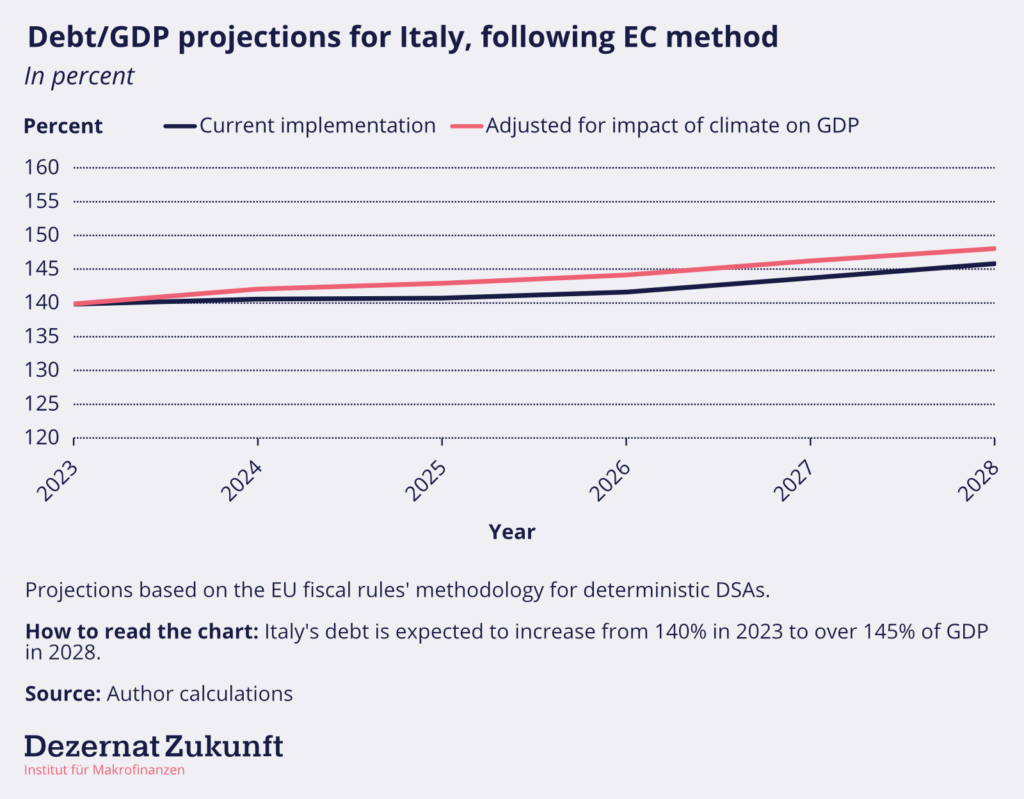

Figure 2

Luckily, the forecasting error seems to be limited, at least for now. But there’s a bigger problem that we should be concerned about.

A Flawed Baseline Leads to Flawed Policy

Not all climate policies affect the economy the same way. Research on this is clear: While carbon pricing can be efficient in theory, relying on it alone is unlikely to get us to net zero without economic pain. The transition also demands public investment—in power grids, charging stations, and other green infrastructure.

And here’s the problem: the current DSAs don’t reflect this. Because the baseline ignores both climate damages and the real costs of climate action, it also overlooks the benefits of smarter policy choices.

Take public investment in the electricity grid. It’s a textbook example of good climate and fiscal policy. Without it, surging carbon prices could leave households and businesses with unreliable electricity and slow economic growth. But under today’s rules, such investment looks like wasted spending. The DSA baseline assumes carbon pricing alone will get us to climate neutrality, with no hit to growth.

A dangerous illusion

As long as DSAs ignore the economic risks of bad climate policy—and the gains from good ones—green investment will seem fiscally irresponsible, even when it’s essential. And countries bound by these rules will be stuck choosing between climate goals and fiscal compliance.

That’s not just bad economics. It’s bad policy.

What Needs to Change?

- Make climate part of the baseline. DSAs should start from a growth forecast that reflects climate damages and emissions limits.

- Model different policy mixes. A carbon pricing-only scenario is unrealistic and potentially damaging. Europe needs tools to compare outcomes of investment-heavy approaches too.

- Recognize the fiscal benefits of climate investment. Smart public spending doesn’t just cost money—it boosts productivity and reduces long-term risks.

- Update the models. Current tools like those from the Network for Greening the Financial System (NGFS) aren’t built for fiscal policy planning. Europe needs tailor-made DSA models that reflect its actual climate laws and policy landscape.

Time to fix the baseline

Europe is legally bound to hit net zero by 2050. Pretending that this won’t affect growth or fiscal outcomes is not just unrealistic—it’s dangerous. If we continue to plan fiscal policy with climate blinders on, we risk underinvesting in the transition and overburdening future generations.

It’s time to fix the baseline. That starts with building better models—and better rules.

Reading Recommendations:

- Here you can find the paper on the topic that we wrote together with our partner Instituut voor Publieke Economie.

- Last year, we wrote a newsletter (in German) about the fact that even with high carbon pricing, there would be a shortfall in the federal budget.

- Institut Avant-garde (EMPN) published on a ‘green debt‘ concept which is a nice complementary approach to ours.

- There’s been a Bruegel podcast which discusses the problem.

The Geldbrief is our newsletter on current developments in economic, fiscal, and monetary policy. We appreciate your feedback and suggestions. Send it to philippa.sigl-gloeckner[at]dezernatzukunft.org

Hat dir der Artikel gefallen?

Teile unsere Inhalte